The Prime Minister Youth Loan Scheme 2025 is a government initiative aimed at empowering young entrepreneurs across Pakistan. This scheme offers interest-free loans to help youth start their own businesses or expand existing ones. If you are between 21 and 45 years old and want to build your career or business, this loan could be your stepping stone.

In this guide, you will learn how to apply for the PM Youth Loan Scheme 2025 online, what documents you need, eligibility criteria, and important tips to increase your chances of approval.

What Is the Prime Minister Youth Loan Scheme 2025?

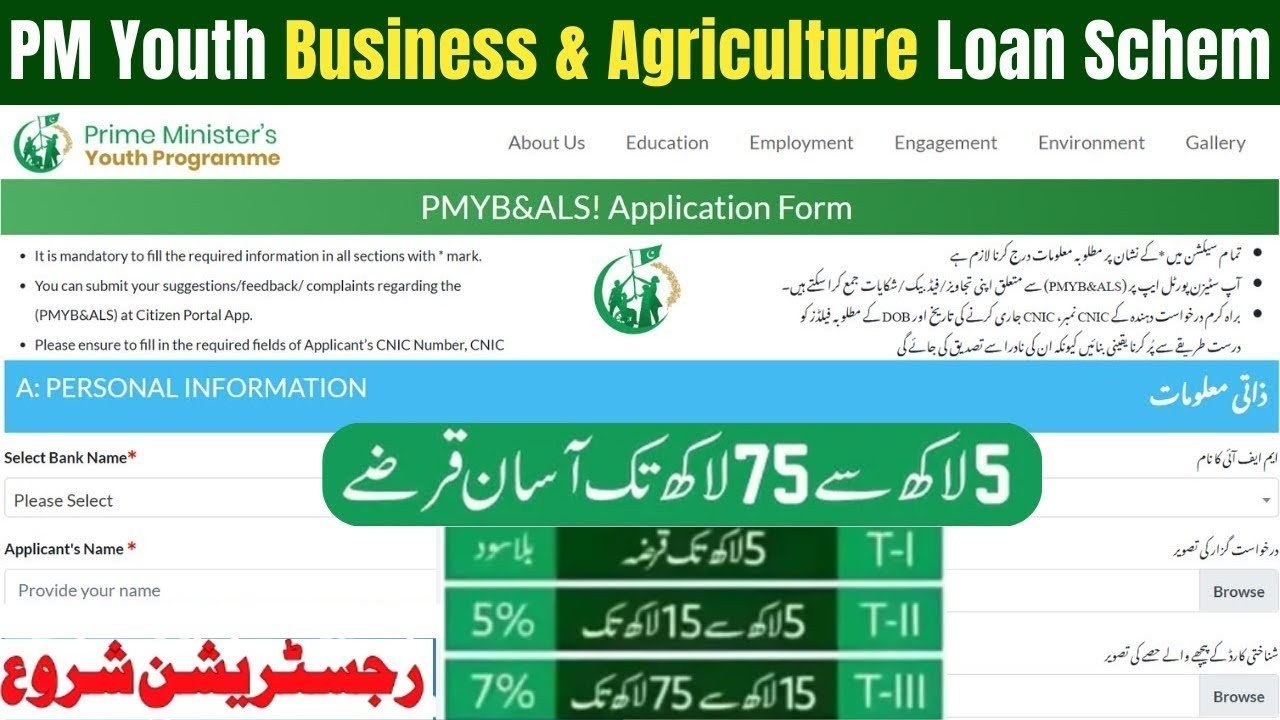

The Prime Minister Youth Loan Scheme was introduced to provide financial support to unemployed youth and small entrepreneurs. The scheme offers loans ranging from PKR 10,000 to PKR 1,000,000 without any collateral or interest for certain categories.

The primary goal is to reduce unemployment and promote self-employment by enabling youth to become financially independent.

Eligibility Criteria for PM Youth Loan Scheme 2025

Before applying, you must ensure you meet the eligibility requirements. These are:

-

Age should be between 21 and 45 years.

-

Must be a Pakistani citizen with a valid CNIC.

-

The applicant should be unemployed or running a small business.

-

Must not have any previous default or outstanding loan from government schemes.

-

Must have a registered mobile number linked with the CNIC.

If you fit these criteria, you are eligible to apply for the loan.

How to Apply for PM Youth Loan Scheme 2025 Online

Applying online for the PM Youth Loan Scheme has made the process quicker and more transparent. Follow these steps to apply easily:

Step 1: Visit the Official Website

Go to the official portal of the Prime Minister Youth Loan Scheme. The authentic website provides all necessary information and application forms. Make sure to use the official URL to avoid scams.

Step 2: Register Yourself

Create an account by entering your CNIC number and other personal details. You will receive an OTP on your registered mobile number to verify your identity.

Step 3: Fill Out the Application Form

Once registered, fill out the online application form carefully. Provide all required information such as:

-

Personal details (name, CNIC, contact information)

-

Educational qualifications

-

Business idea or existing business details

-

Loan amount required

-

Bank account information for disbursement

Step 4: Upload Required Documents

You need to upload scanned copies of important documents, including:

-

CNIC

-

Business registration documents (if any)

-

Bank account details

-

Educational certificates

Make sure all documents are clear and valid.

Step 5: Submit the Application

After completing the form and uploading documents, review your application for any mistakes. Then submit the form.

Step 6: Wait for Verification

The authorities will verify your information and documents. This process may take a few days. You can track your application status on the same portal using your registration ID.

Required Documents for PM Youth Loan Scheme 2025

To avoid rejection, prepare these documents before applying:

-

Valid CNIC copy

-

Proof of business or business plan (for startups)

-

Bank account details (must be verified)

-

Educational certificates

-

Proof of residence (utility bill or similar)

Keep the digital copies ready in JPG or PDF format for quick upload.

Tips to Increase Approval Chances

Approval depends on various factors like eligibility, documentation, and business plan. Here are some tips:

-

Submit a clear and concise business plan explaining how you will use the loan.

-

Ensure your bank account is active and has your name.

-

Avoid providing false or incomplete information.

-

Apply early to avoid last-minute issues.

-

Follow up regularly on your application status.

What Happens After Approval?

Once your loan is approved:

-

You will receive confirmation via SMS or email.

-

The loan amount will be transferred directly to your bank account.

-

You must use the loan strictly for the business purposes mentioned.

-

Timely repayment according to the schedule is essential to maintain your credit record.

Common FAQs About PM Youth Loan Scheme 2025

Q1: Is collateral required for this loan?

No, the scheme offers collateral-free loans for small amounts.

Q2: Can women apply for this loan?

Yes, the scheme encourages women entrepreneurs to apply.

Q3: How long does the approval process take?

Usually, it takes about 2 to 4 weeks for verification and approval.

Q4: Can I apply if I already have a loan from another scheme?

No, applicants with active government loans are generally not eligible.

Q5: What if my application is rejected?

You can reapply after correcting errors or after the waiting period defined by the scheme.

Conclusion

The Prime Minister Youth Loan Scheme 2025 is a great opportunity for young people to take control of their financial future. By following the online application steps carefully and submitting the right documents, you can secure a loan to kickstart your business.

Make sure to check the official website regularly for updates and notifications. Apply smartly and be patient during the verification process. This loan can be the boost you need to turn your ideas into reality.